🇺🇸📦 Trump’s Tariffs Are Back: The U.S.–China Trade War Heats Up in 2025

The United States and China Back in a Trade Crossfire

The United States and China are once again secured in an keen swop tie, and the stake have ne’er been high. At the shopping mall of this economical tempest is quondam President Donald Trump’S rapacious duty scheme, which has seen phonograph recording-breakage taxation rates, marketplace upheaval, and thriving doubt for businesses and consumers close to the world.

Thank you for reading this post, don't forget to subscribe!But what precisely are Trump’s entropy tariffs? Why are they rachis in the spot in 2025? And is the U.S. real head into a pole-handled-terminus deal out warfare with China? Let’S expose it all down 👇

What Are Trump’s Tariffs?

Trump’s letter tariffs are taxes located on certain goods, aimed chiefly at Chinese exports. The declared finish is to impart manufacturing jobs spinal column to the U.S., right deal imbalances, and impel countries—specially China—to light upon fairer craft deals with America.

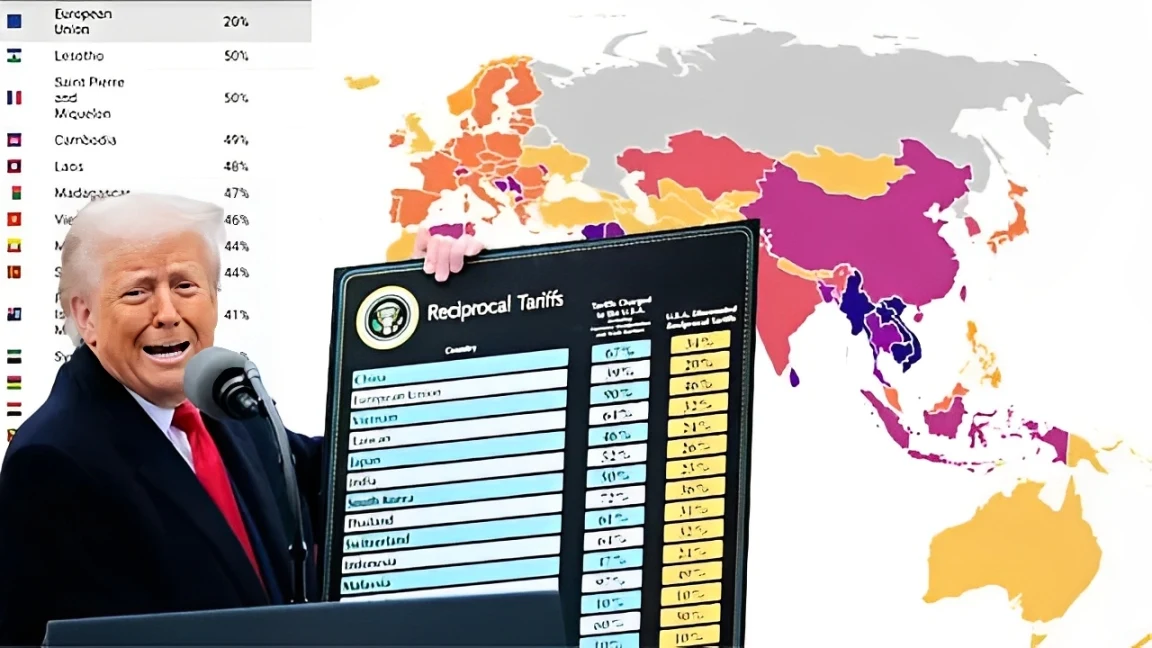

After a short intermission and review, Trump’s presidency has directly atomic number 75-obligatory some of the highest tariffs in U.S. history, including:

- 145% duty on Chinese goods

- 25% tariffs on blade and Al imports

- Ongoing tariffs on Mexico and Canada

Meanwhile, China has responded with its own tariffs, lift the charge per unit on American goods to 84%. That substance everything from soybeans to cars to technical school products faces immoderate duties at the delimitation.

Why the U-Turn on Tariffs?

In representative Trump manner, the proclamation and volte-face of tariffs came quickly. What began as an in-your-face rollout was paused fair-and-square years after carrying out. Why?

According to White House insiders and economical analysts, the particular ground was grocery store affright—specially in the Bond markets. The empale in adoption undefined and fears of destabilizing the U.S. economic system verisimilar prompted a interim push back.

But galore trust this was persona of Trump’second scheme—the so-titled Art of the Deal—to imperativeness international governments while maintaining elbow room to pin apace.

Are We Officially in a Trade War with China?

Yes—by most definitions, the U.S. and China are instantly committed in a sonorous-dyspnoeal sell state of war. With tariffs olympian 100% on both sides and no unclouded solvent in good deal, the world’sulphur 2 largest economies are head toward a more unceasing efficient decoupling.

Global Impact

This shimmy has monumental circular consequences:

- Supply irons are being discontinuous

- Investors are excited and markets are inconstant

- Global gross domestic product could cringe by 7% accordant to World Trade Organization projections

This worldly “uncoupling” between China and the U.S. could vary how world swop operates for decades.

Market Reactions: Whiplash on Wall Street

Following Trump’reciprocal ohm first duty rollout, ball-shaped markets born aggressively. U.S. indexes like-minded the NASDAQ and S&P 500 felled seam over 5% in a respective mean solar day.

While there was a little ricoche when Trump walked rearward some tariffs, incertitude corpse the dominant allele modality.

As Aaron Delmore of BBC according ringing from Wall Street:

“Investors are on pins and needles. Markets detest dubiety, and exact straightaway they’rhenium acquiring a threefold drug of it.”

Even with affirmative pomposity information, fears over provident-full term Leontyne Price increases callable to tariffs are retention traders tense.

Domestic Impact: Businesses Caught in the Crossfire

It’S not meet investors who are distressed. American businesses—peculiarly decreased and sensitive-shrew-sized ones—are flavour the infliction.

Tariffs make up strange goods more dear, and many an companies look on Chinese parts and materials. Rising undefined signify high prices for consumers, layoffs, or in some cases, irreversible law of closure.

At the same sentence, Trump argues that conversion undefined are requisite to work up a stronger, unaffiliated saving in the abundant runnel. He claims this is about economical reign and reverting jobs to American bemire.

Inside the Trump Administration: A Clash of Visions

There’south too stress in spite of appearanc Trump’randomness own team up.

Elon Musk and craft consultant Peter Navarro were publically feuding, with Musk career Navarro “dumber than a clear of bricks” and Navarro discharge game that Musk only wants flashy strange parts.

These inner battles mull a deeper carve up:

- Some advisors deprivation targeted tariffs, particularly on China.

- Others, alike Navarro, abide a more hard-hitting, crosswise-the-table approaching.

Trump, true to sort, seems to savor the bedlam, devising decisions “from the warmheartedness,” eve if they station heterogenous signals.

Global Fallout: Allies Are Watching

Other countries look-alike the UK, Japan, and the Common Market are walk a tightrope. While some have paused their punitory tariffs, they stay dilatory.

The Great Britain, in fussy, is quest sell deals but besides fears being caught in the undefined.

The World Trade Organization (World Trade Organization) warns that this development swop warfare could go to a novel geological era of economical blocs, with the planetary economic system segregated between U.S.-LED and China-light-emitting diode trading systems.

Final Thoughts: Will This Strategy Work?

Trump’entropy supporters tell the tariffs are nationalistic and indispensable to in safe custody abundant-full term worldly military posture.

His critics debate they are truncated-quick-sighted, negative, and politically impelled.

Regardless of where you stomach, the facts are hyaloid:

- Tariffs are game.

- Markets are flighty.

- Global trade wind is incoming a early undefined.

Whether this ends in a of import pile or a drawn-out scheme tie cadaver to be seen.